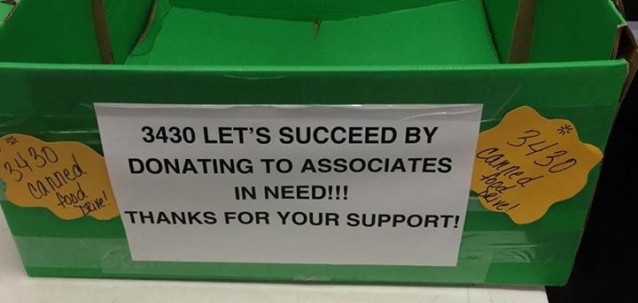

An Oklahoma City Walmart is asking employees to donate food to help their coworkers make ends meet during the holiday season. The company drew criticism for similar employee food drives a year ago. Besides incurring a total public assistance cost of $6.2 billion per year, Walmart has been criticized for running a corporate charity called the Associates in Critical Need Fund, which recently made the news because the company uses it to lure corporate employees into chipping into the company PAC that spends money to influence elections and lawmakers.

Questions:

1. An employee snapped the photo below, but did not want to be identified. Why?

2. Why is Walmart facing formal charges? What have they been accused of doing?

3. Can you make a journal entry for paid sick leave for the Oklahoma City Walmart employees? Why or why not?

4. Discuss the strategic management costs and benefits for Walmart’s employment of more full-time workers? Which position do you favor?

Source:

Pyke, A. (2014). Walmart Asks Employees To Donate Food To Help Feed Their Coworkers. ThinkProgress.org, Nov. 20 (Retrievable online at http://thinkprogress.org/economy/2014/11/20/3595067/walmart-food-drive-oklahoma/)

Covert, B. (2014). National Labor Relations Board To Prosecute Walmart For Violating Workers’ Rights. ThinkProgress.org, Nov. 18 (Retrievable online at http://thinkprogress.org/economy/2013/11/18/2962751/nlrb-walmart/)