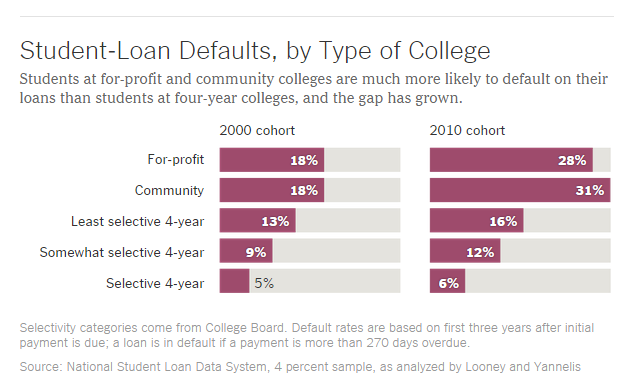

New data suggests that many popular perceptions of student debt are incorrect. The huge run-up in loans and the subsequent spike in defaults have not been driven by $100,000 debts incurred by students at expensive private colleges. Instead, they are driven by $8,000 loans at for-profit colleges and, to a lesser extent, community colleges. Borrowing for both of these has become far more common in recent years.

Questions:

1.What is responsible for the 75% increase in defaults between 2004 and 2011?

2. What is the logic behind the types of students that default?

3. How has the landscape of student borrowers changed over the last 20 years and what factors drove the rapid change in the last few years?

Source:

Dynarski, S. (2015). New Data Gives Clearer Picture of Student Debt. The New York Times, Sep. 10 (Retrievable online at http://www.nytimes.com/2015/09/11/upshot/new-data-gives-clearer-picture-of-student-debt.html)